Ten things to know about Canada’s 2021 federal budget

Ten things to know about Canada’s 2021 federal budget

La version française de ce billet se trouve ici.

On April 21, the Trudeau government tabled the 2021 federal budget. The budget includes additional COVID-related measures,[1] a major childcare initiative, and various forms of support for low-income Canadians (including for housing and homelessness).

Here are 10 things to know.

1. The budget commits “up to $30 billion over five years” for early learning and childcare. The Government of Canada sets out the following goal: “That, in the next 5 years, Canadian parents across the country have access to high quality early learning and childcare, for an average of $10 a day.” This may be the single most important social policy announcement made by any federal government at any point in the past 25 years. But in order for this to be successful, considerable cooperation will be required from provincial and territorial governments.

2. The budget announces major changes to financial assistance for post-secondary students. The Government of Canada is making the grant system more generous and the loan system more forgiving. While the value of grants had doubled as a COVID measure, the budget announces that these enhanced amounts will remain in place until July 2023. Also, students earning less than $40,000 will now be exempt from making payments on their loans, while the previous threshold had been $25,000.[2]

3. The budget proposes important support for seniors, including for long-term care and income support. The budget proposes $3 billion over five years “to support provinces and territories in ensuring standards for long-term care are applied…” The budget also proposes a one-time payment of $500 in August 2021 to Old Age Security (OAS) recipients aged 75 or over. It further proposes to introduce legislation that would permanently increase OAS payments for recipients aged 75 and over by 10%.

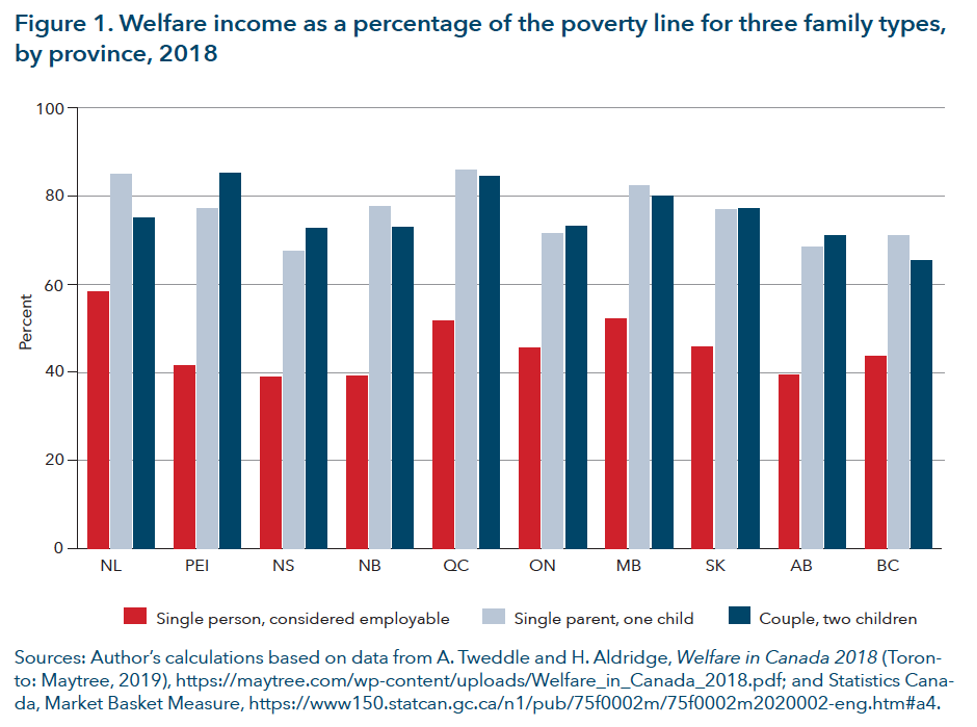

4. Low-wage workers will receive additional assistance. The Government of Canada announced its intention to raise the federal minimum wage to $15/hr., indexed to inflation, “with provisions to ensure that where provincial or territorial minimum wages are higher, that wage will prevail.” This directly affects over 26,000 workers in the federally-regulated private sector. The budget also proposes to expand the Canada Workers Benefit to support approximately 1 million additional Canadians in low-wage jobs, meaning “that for the first time, most full-time workers earning minimum wage will receive significant support from this important benefit…A single, full-time, minimum wage worker could receive about $1,000 more in benefits than they would under the current system…” This will be especially helpful for single adults without dependants.[3]

5. The budget proposes important new investments for Indigenous peoples. This includes “more than $6 billion to help close infrastructure gaps in Indigenous communities, and $2.2 billion for actions to end the national tragedy of missing and murdered Indigenous women and girls.” It did not announce an urban, rural and northern Indigenous housing strategy, as many advocates had expected.

6. The budget announces $1.5 billion in new funding for the Rapid Housing Initiative (RHI). Launched in September 2020, this program focuses on the creation of modular housing, the acquisition of land, and the conversion of existing buildings into affordable housing. RHI provides up-front grants for each unit, but relies on provincial and territorial governments to fund ongoing costs.

7. The Canada Housing Benefit will be enhanced. Specifically, an additional $315.4 million over seven years has been committed “for low-income women and children fleeing violence to help with their rent payments.” This benefit was first announced in November 2017. Unfortunately, many provincial and territorial governments have been slow to sign bilateral agreements with the Government of Canada, thus delaying take up.

8. The National Housing Co-Investment Fund (NHCF) has received enhancements. This includes $750 million in new funding, as well as $250 million to support the construction, repair, and operating costs of transitional housing and shelter spaces for women and children fleeing violence (however, it is not clear how much of this consists of grants vs. loans). The NHCF, originally announced in 2017, contains both grants and loans, but has been criticized for being mostly a loan program. It has also been criticized for its onerous application and approval process.

9. This government continues to increase annual funding for homelessness. This budget proposes an additional $567 million over two years, beginning in 2022-23, for Reaching Home (i.e., the federal government’s main funding vehicle for homelessness). This preserves the 2021-22 funding levels announced in the Fall Economic Statement in response to the pandemic. The budget also proposes $45 million over two years for a pilot program “aimed at reducing veteran homelessness through the provision of rent supplements and wrap-around services for homeless veterans such as counselling, addiction treatment, and help finding a job.”

10. An assortment of other housing-related measures was announced. This includes: a national 1% tax on vacant property owned by non-residents; $600 million over seven years “to renew and expand the Affordable Housing Innovation Fund, which encourages new funding models and innovative building techniques in the affordable housing sector;” $118.2 million over seven years for the Federal Community Housing Initiative (for operators of federally-administered co-op housing units); a reallocation of $300 million in loan funds from the Rental Construction Financing Initiative to support the conversion of vacant commercial property into rental housing; $25 million in new housing funding for the Northwest Territories; and $25 million in housing for Nunavut.

In sum. This budget contains important new social investments, especially for childcare. It includes important new funding enhancements for low-income Canadians, including for affordable housing and homelessness. And it does so at a time when federal debt-serving costs are low by historical standards due to low interest rates.

I wish to thank the following individuals for assistance with this blog post: George Fallis, Martha Friendly, Rob Gillezeau, Michel Laforge, David Macdonald, Rianne Mahon, Michael Mendelson, Jeff Morrison, Steve Pomeroy, Shayne Ramsay, Sylvia Regnier, Vincent St-Martin and Greg Suttor. I also wish to thank HomeSpace Society for permission to use the photo that appears above.

—

[1] These include the extension of the wage subsidy, rent subsidy, and Lockdown Support for businesses and other employers until September 2021. Together, these particular measures amount to $12.1 billion in additional support.

[2] For a thorough overview of all changes announced to post-secondary education, check out this analysis.

[3] For more on the income-related challenges of single adults without dependants, see this recent report.